Are there any specific maintenance requirements for stocks in the cryptocurrency market?

What are the specific maintenance requirements that need to be considered for stocks in the cryptocurrency market? How should investors and traders manage their stocks in terms of maintenance to ensure optimal performance and minimize risks?

3 answers

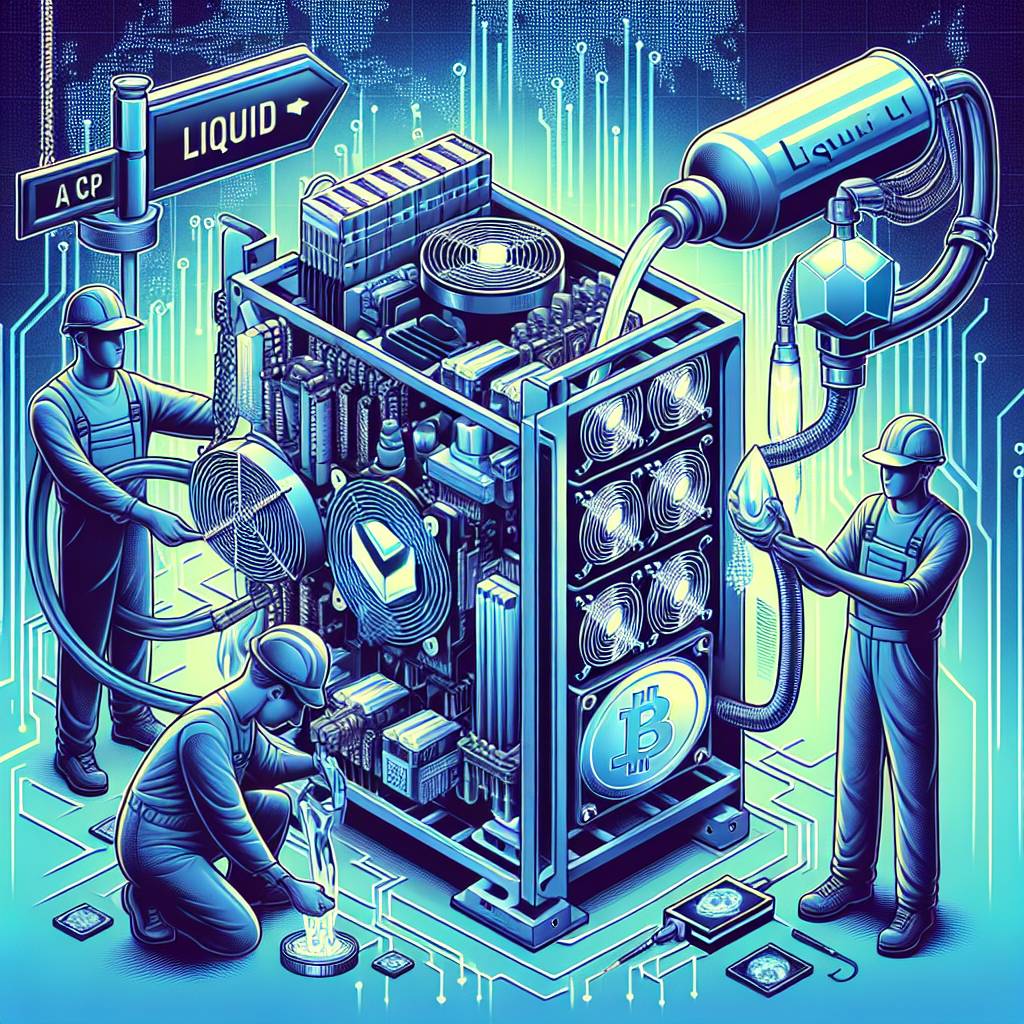

- As a cryptocurrency investor, it's important to understand that stocks in the cryptocurrency market require regular maintenance to ensure their performance and mitigate risks. Here are a few key maintenance requirements to consider: 1. Stay updated with market news and trends: Keep yourself informed about the latest developments in the cryptocurrency market, including regulatory changes, technological advancements, and market sentiment. This will help you make informed decisions and adjust your stock portfolio accordingly. 2. Monitor your stock performance: Regularly track the performance of your stocks and analyze their price movements. Use technical analysis tools and indicators to identify potential buying or selling opportunities. 3. Diversify your stock portfolio: Spread your investments across different cryptocurrencies and sectors to minimize the impact of market volatility. This will help you reduce the risk of losing all your investments in case of a downturn in a specific cryptocurrency or sector. 4. Set stop-loss orders: Consider setting stop-loss orders to automatically sell your stocks if they reach a certain price level. This can help you limit your losses and protect your capital. Remember, maintenance requirements may vary depending on your investment strategy and risk tolerance. It's always a good idea to consult with a financial advisor or do thorough research before making any investment decisions.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - When it comes to maintaining stocks in the cryptocurrency market, there are a few important factors to consider. Firstly, it's crucial to stay updated with the latest news and developments in the cryptocurrency industry. This can help you identify potential risks or opportunities that may affect the performance of your stocks. Additionally, regularly monitoring the performance of your stocks and conducting technical analysis can provide valuable insights into market trends and price movements. Diversifying your stock portfolio is also recommended to mitigate risks and reduce the impact of market volatility. Finally, setting stop-loss orders can be a useful risk management strategy to protect your investments. By implementing these maintenance requirements, you can better manage your stocks in the cryptocurrency market.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - In the cryptocurrency market, stocks require regular maintenance to ensure optimal performance. As an investor, it's important to stay informed about the latest market trends and news. This can help you make informed decisions and adjust your stock portfolio accordingly. Monitoring the performance of your stocks and conducting technical analysis can provide insights into market trends and potential buying or selling opportunities. Diversifying your stock portfolio across different cryptocurrencies and sectors can help mitigate risks and minimize the impact of market volatility. Setting stop-loss orders can also be beneficial to protect your investments. Overall, proper maintenance of stocks in the cryptocurrency market is essential for successful investing.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago

Related Tags

Hot Questions

- 97

Are there any special tax rules for crypto investors?

- 95

What are the best practices for reporting cryptocurrency on my taxes?

- 82

How can I protect my digital assets from hackers?

- 78

How does cryptocurrency affect my tax return?

- 59

How can I buy Bitcoin with a credit card?

- 41

What are the tax implications of using cryptocurrency?

- 37

What are the advantages of using cryptocurrency for online transactions?

- 36

How can I minimize my tax liability when dealing with cryptocurrencies?