How can I use level 2 data to improve my cryptocurrency trading strategies?

I'm interested in leveraging level 2 data to enhance my cryptocurrency trading strategies. Can you provide some insights on how I can effectively use level 2 data to make better trading decisions?

3 answers

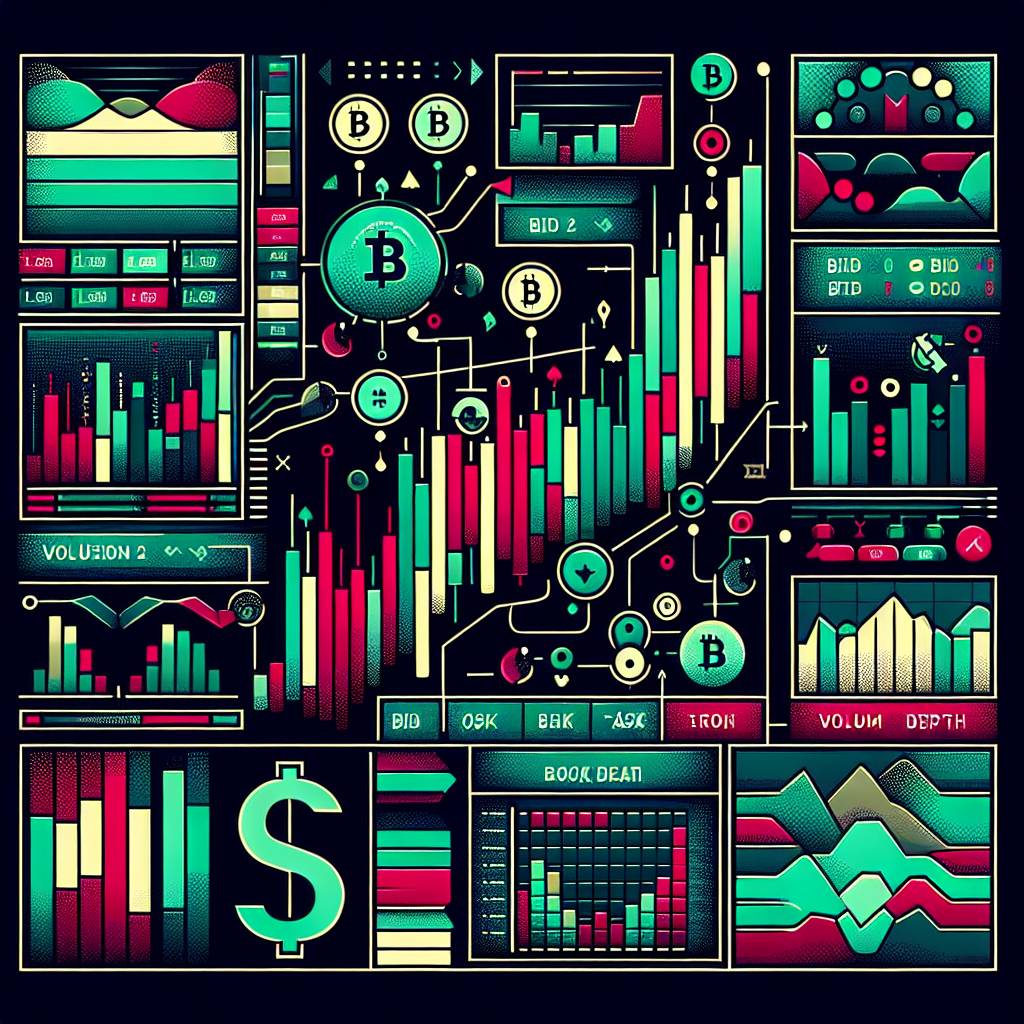

- Using level 2 data in cryptocurrency trading can provide valuable insights into market depth and liquidity. By analyzing the order book and observing the bid and ask prices, you can identify potential support and resistance levels. This information can help you determine the best entry and exit points for your trades, improving your overall profitability. Additionally, level 2 data can help you spot large buy or sell orders, indicating potential market manipulation or significant price movements. By incorporating level 2 data into your trading strategies, you can gain a competitive edge in the cryptocurrency market.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - Level 2 data is a powerful tool for cryptocurrency traders. It allows you to see the real-time order flow and market depth, giving you a better understanding of supply and demand dynamics. With level 2 data, you can identify areas of high buying or selling pressure, which can help you anticipate price movements and make more informed trading decisions. By combining level 2 data with technical analysis and other indicators, you can develop robust trading strategies that take advantage of market inefficiencies and maximize your profits.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - As an expert in the field, I can tell you that level 2 data is a game-changer for cryptocurrency traders. It provides a detailed view of the market, allowing you to see the orders beyond the top bid and ask prices. This information can help you gauge the strength of support and resistance levels, identify potential breakouts or reversals, and spot hidden buying or selling pressure. By using level 2 data, you can fine-tune your trading strategies and make more accurate predictions about price movements. It's a must-have tool for serious cryptocurrency traders.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago

Related Tags

Hot Questions

- 96

How can I buy Bitcoin with a credit card?

- 85

What are the best practices for reporting cryptocurrency on my taxes?

- 77

How does cryptocurrency affect my tax return?

- 77

How can I protect my digital assets from hackers?

- 59

What are the advantages of using cryptocurrency for online transactions?

- 51

What are the best digital currencies to invest in right now?

- 34

What is the future of blockchain technology?

- 31

How can I minimize my tax liability when dealing with cryptocurrencies?