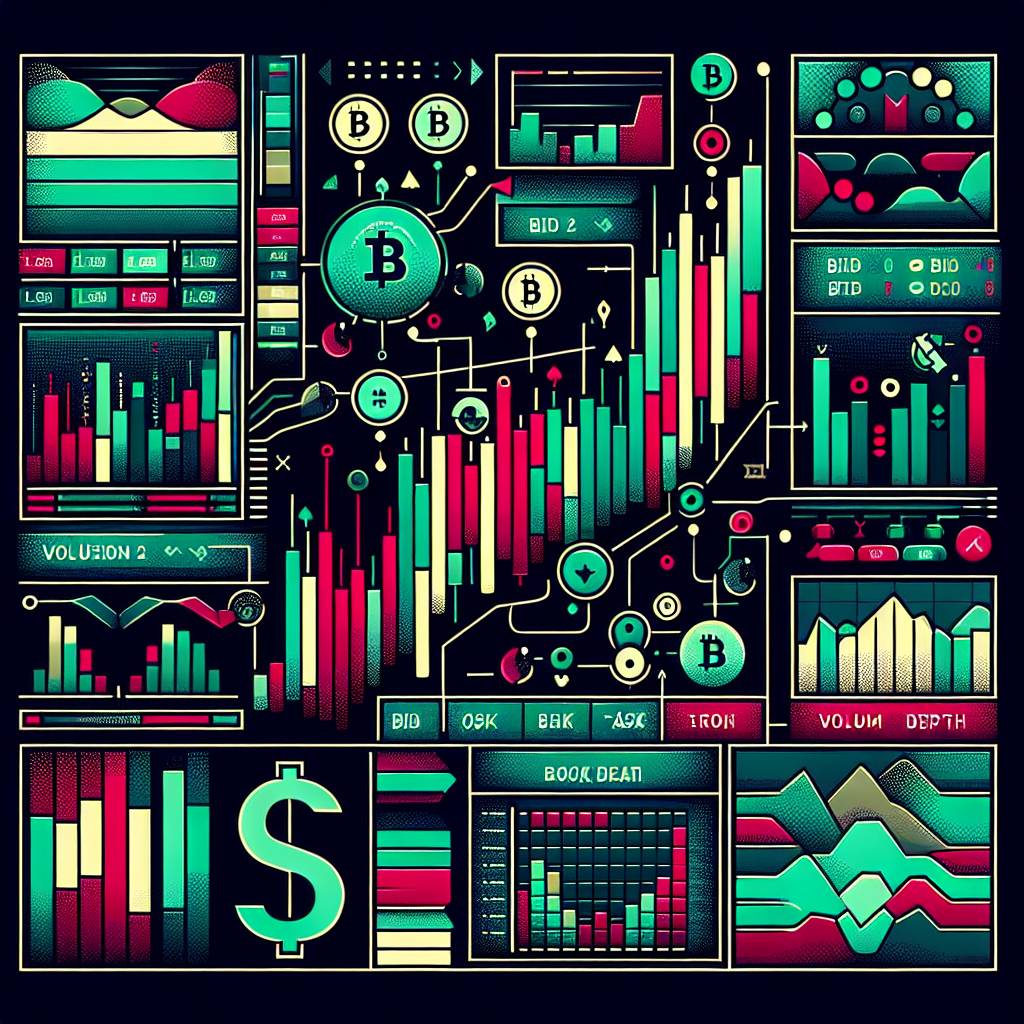

How can level 2 data help traders make more informed decisions in the cryptocurrency market?

What is level 2 data and how can it be used by traders to make more informed decisions in the cryptocurrency market?

3 answers

- Level 2 data refers to real-time market data that provides traders with detailed information about the current supply and demand levels for a particular cryptocurrency. By analyzing level 2 data, traders can gain insights into the depth of the market and identify potential buying or selling opportunities. For example, they can see the number of buy and sell orders at different price levels, which can help them understand the market sentiment and make more informed decisions. Additionally, level 2 data can also reveal the liquidity of a cryptocurrency, allowing traders to assess the ease of buying or selling large quantities without significantly impacting the market price. Overall, level 2 data is a valuable tool for traders to enhance their understanding of the market and make better-informed trading decisions.

Nov 29, 2021 · 3 years ago

Nov 29, 2021 · 3 years ago - Level 2 data is like having X-ray vision for the cryptocurrency market. It provides traders with a deeper view of the market by showing the order book, which includes all the buy and sell orders at different price levels. This information can help traders gauge the market sentiment and identify potential support and resistance levels. By analyzing level 2 data, traders can make more informed decisions about when to enter or exit a trade. For example, if they see a large number of buy orders at a specific price level, it may indicate strong buying pressure and a potential upward movement in the price. On the other hand, if they see a significant number of sell orders, it may suggest selling pressure and a possible price decline. Level 2 data empowers traders with valuable insights that can give them an edge in the cryptocurrency market.

Nov 29, 2021 · 3 years ago

Nov 29, 2021 · 3 years ago - Level 2 data is a game-changer for traders in the cryptocurrency market. With level 2 data, traders can see the order book of a cryptocurrency exchange, which provides them with a detailed view of the supply and demand dynamics. This information can help traders make more informed decisions by allowing them to assess the market depth and liquidity. For example, if they see a large number of buy orders at a specific price level, it may indicate strong demand and a potential price increase. Conversely, if they see a significant number of sell orders, it may suggest selling pressure and a possible price decrease. By using level 2 data, traders can better understand the market dynamics and adjust their trading strategies accordingly. It's like having a crystal ball that reveals the hidden forces driving the cryptocurrency market.

Nov 29, 2021 · 3 years ago

Nov 29, 2021 · 3 years ago

Related Tags

Hot Questions

- 82

What are the best practices for reporting cryptocurrency on my taxes?

- 73

How does cryptocurrency affect my tax return?

- 66

Are there any special tax rules for crypto investors?

- 65

What are the best digital currencies to invest in right now?

- 64

How can I buy Bitcoin with a credit card?

- 62

What are the tax implications of using cryptocurrency?

- 56

How can I minimize my tax liability when dealing with cryptocurrencies?

- 50

How can I protect my digital assets from hackers?