How can level 2 market data be used to make informed cryptocurrency trading decisions?

What are some strategies for using level 2 market data to make more informed decisions when trading cryptocurrencies?

3 answers

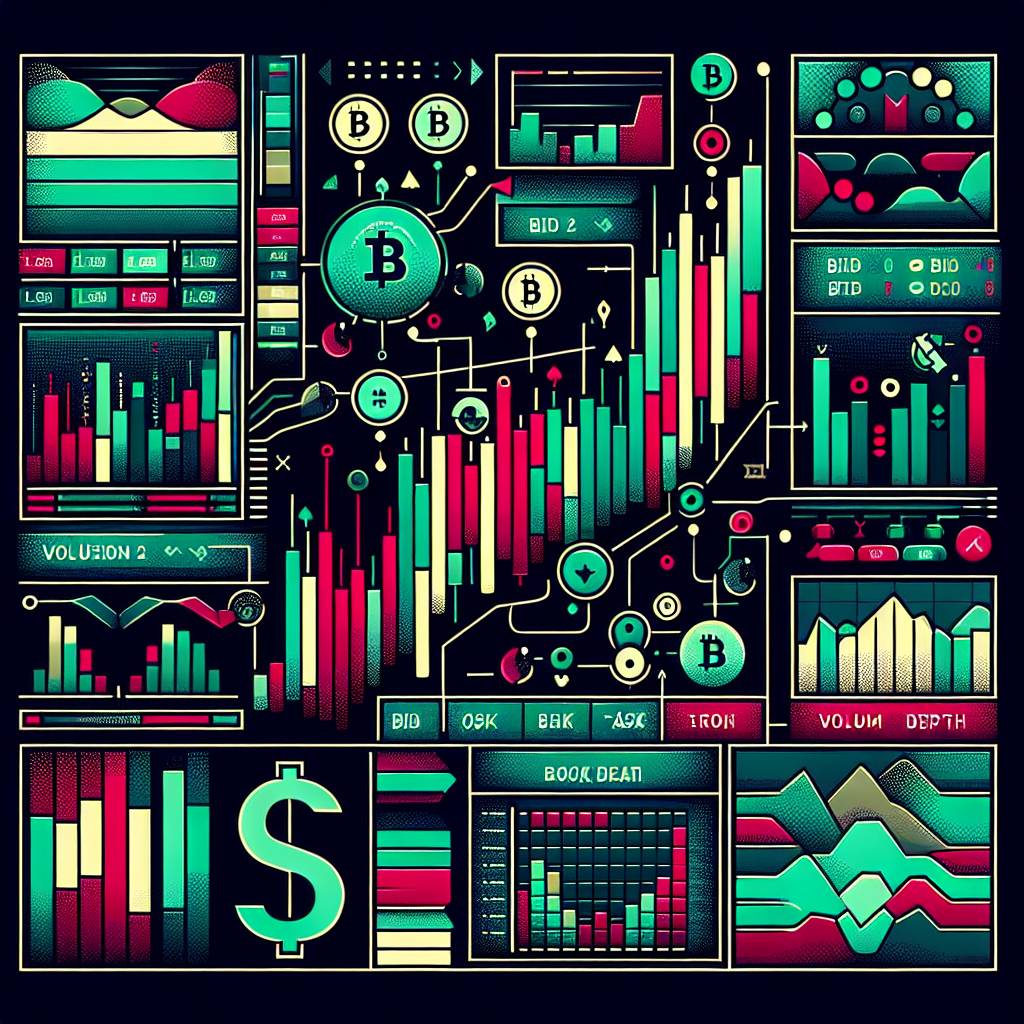

- One strategy for using level 2 market data to make more informed cryptocurrency trading decisions is to analyze the order book. By examining the buy and sell orders at different price levels, traders can gain insights into the market depth and potential price movements. This information can help them identify support and resistance levels, as well as detect trends and patterns. Additionally, level 2 market data can be used to assess market liquidity and determine the likelihood of executing trades at desired prices. Overall, incorporating level 2 market data analysis into cryptocurrency trading strategies can provide traders with a more comprehensive understanding of the market dynamics and improve their decision-making process.

Dec 15, 2021 · 3 years ago

Dec 15, 2021 · 3 years ago - Level 2 market data can be a valuable tool for cryptocurrency traders to make informed trading decisions. By monitoring the real-time order flow and depth, traders can gain insights into the supply and demand dynamics of a particular cryptocurrency. This information can help them identify potential buying or selling opportunities, as well as assess the overall market sentiment. Additionally, level 2 market data can provide traders with a better understanding of the market liquidity and the presence of large buyers or sellers. By incorporating level 2 market data analysis into their trading strategies, traders can make more informed decisions and potentially improve their trading performance.

Dec 15, 2021 · 3 years ago

Dec 15, 2021 · 3 years ago - As an expert at BYDFi, I can tell you that level 2 market data is an essential tool for making informed cryptocurrency trading decisions. By analyzing the order book and monitoring the real-time buy and sell orders, traders can gain valuable insights into the market depth and liquidity. This information can help them identify potential price levels for entering or exiting trades, as well as assess the overall market sentiment. Additionally, level 2 market data can be used to detect market manipulation or abnormal trading activities. By incorporating level 2 market data analysis into their trading strategies, traders can make more informed decisions and increase their chances of success in the cryptocurrency market.

Dec 15, 2021 · 3 years ago

Dec 15, 2021 · 3 years ago

Related Tags

Hot Questions

- 88

How can I minimize my tax liability when dealing with cryptocurrencies?

- 88

How can I buy Bitcoin with a credit card?

- 74

What are the best practices for reporting cryptocurrency on my taxes?

- 64

Are there any special tax rules for crypto investors?

- 63

How does cryptocurrency affect my tax return?

- 54

What are the best digital currencies to invest in right now?

- 48

What is the future of blockchain technology?

- 22

What are the tax implications of using cryptocurrency?