How do the returns on cryptocurrencies differ from those on bonds and interest rates?

What are the differences in returns between cryptocurrencies and bonds and interest rates?

3 answers

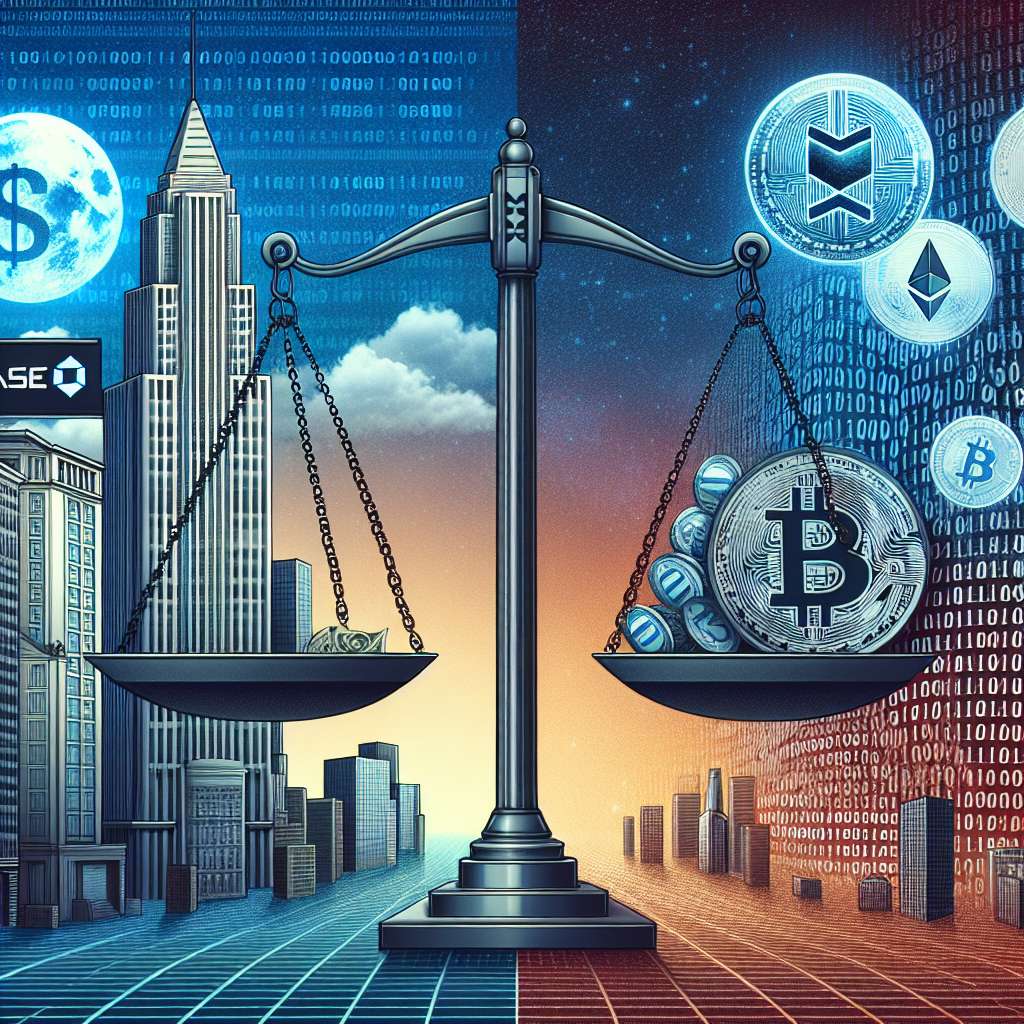

- Cryptocurrencies and bonds/interest rates have different returns due to their inherent characteristics. Cryptocurrencies, like Bitcoin, are highly volatile and can experience significant price fluctuations in a short period of time. This volatility can lead to high returns for investors who time their trades correctly. On the other hand, bonds and interest rates offer more stable returns over a longer period of time. They are considered safer investments with lower risk compared to cryptocurrencies. However, the returns on bonds and interest rates are generally lower than the potential returns of cryptocurrencies. So, while cryptocurrencies offer the possibility of higher returns, they also come with higher risks.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - When it comes to returns, cryptocurrencies are like a roller coaster ride, while bonds and interest rates are more like a steady train journey. Cryptocurrencies can provide massive returns in a short span of time, but they can also crash just as quickly. On the other hand, bonds and interest rates offer a more predictable and stable return on investment. So, if you're looking for quick gains and are willing to take on higher risks, cryptocurrencies might be the way to go. But if you prefer a safer and more consistent return, bonds and interest rates are the better option.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - According to a study conducted by BYDFi, the returns on cryptocurrencies are generally higher than those on bonds and interest rates. This is mainly due to the high volatility and potential for rapid price appreciation in the cryptocurrency market. However, it's important to note that investing in cryptocurrencies also comes with higher risks. The study found that while the average annual returns on cryptocurrencies were higher, the volatility and unpredictability of the market made it a riskier investment compared to bonds and interest rates. Therefore, investors should carefully consider their risk tolerance and investment goals before deciding between cryptocurrencies, bonds, and interest rates.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago

Related Tags

Hot Questions

- 93

What are the advantages of using cryptocurrency for online transactions?

- 87

How can I protect my digital assets from hackers?

- 64

Are there any special tax rules for crypto investors?

- 59

How does cryptocurrency affect my tax return?

- 56

How can I minimize my tax liability when dealing with cryptocurrencies?

- 46

What are the best digital currencies to invest in right now?

- 44

What are the best practices for reporting cryptocurrency on my taxes?

- 18

What is the future of blockchain technology?