How does investing in cryptocurrencies differ from investing in individual stocks?

What are the key differences between investing in cryptocurrencies and investing in individual stocks?

3 answers

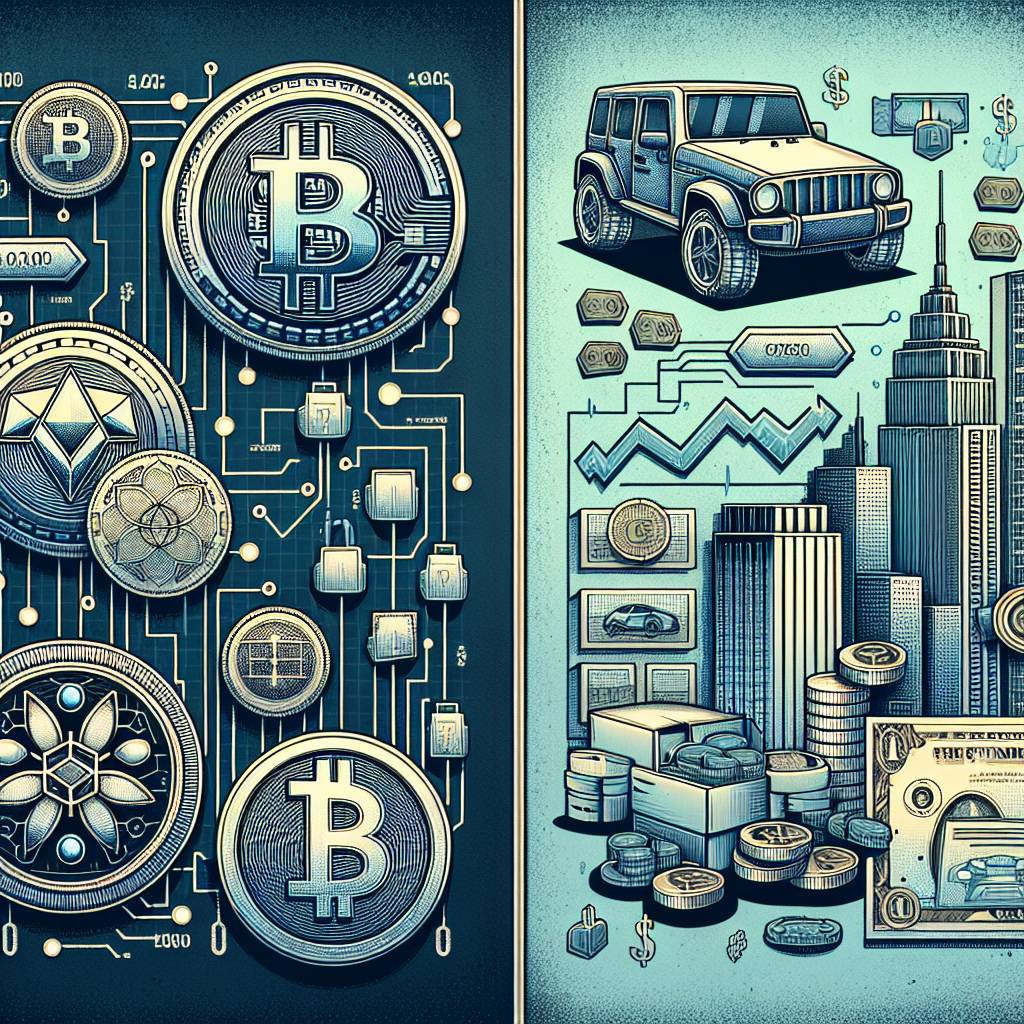

- Investing in cryptocurrencies differs from investing in individual stocks in several ways. Firstly, cryptocurrencies are digital assets that operate on blockchain technology, while individual stocks represent ownership in a specific company. This fundamental difference in nature affects the risk and potential returns associated with each investment. Secondly, the cryptocurrency market is highly volatile and decentralized, whereas the stock market is more regulated and stable. Additionally, investing in cryptocurrencies often involves trading on cryptocurrency exchanges, while investing in individual stocks typically takes place on traditional stock exchanges. Overall, investing in cryptocurrencies requires a different set of knowledge and strategies compared to investing in individual stocks.

Nov 23, 2021 · 3 years ago

Nov 23, 2021 · 3 years ago - When it comes to investing, cryptocurrencies and individual stocks have distinct characteristics. Cryptocurrencies, such as Bitcoin and Ethereum, are decentralized digital currencies that operate on blockchain technology. On the other hand, individual stocks represent ownership in a specific company and are traded on stock exchanges. The main difference lies in the underlying technology, market dynamics, and risk factors. Cryptocurrencies are known for their high volatility and potential for significant gains or losses in a short period. Individual stocks, while also subject to market fluctuations, are influenced by factors such as company performance, industry trends, and economic conditions. It's important to carefully consider these differences and conduct thorough research before making investment decisions in either asset class.

Nov 23, 2021 · 3 years ago

Nov 23, 2021 · 3 years ago - Investing in cryptocurrencies differs from investing in individual stocks in a few key ways. Firstly, cryptocurrencies are not tied to any specific company or industry. Instead, they are digital assets that operate on decentralized networks. This means that the value of cryptocurrencies is influenced by factors such as market demand, technological advancements, and regulatory developments. On the other hand, investing in individual stocks involves analyzing the financial performance and prospects of specific companies. Secondly, the cryptocurrency market operates 24/7, while stock markets have specific trading hours. This constant availability can lead to increased volatility and trading opportunities in the cryptocurrency market. Lastly, investing in cryptocurrencies often requires using specialized cryptocurrency exchanges, whereas investing in individual stocks can be done through traditional brokerage accounts. It's important to carefully consider these differences and choose investment strategies that align with your risk tolerance and financial goals.

Nov 23, 2021 · 3 years ago

Nov 23, 2021 · 3 years ago

Related Tags

Hot Questions

- 82

How can I buy Bitcoin with a credit card?

- 81

How can I protect my digital assets from hackers?

- 78

What are the tax implications of using cryptocurrency?

- 67

How does cryptocurrency affect my tax return?

- 63

How can I minimize my tax liability when dealing with cryptocurrencies?

- 51

What are the best digital currencies to invest in right now?

- 22

What is the future of blockchain technology?

- 19

Are there any special tax rules for crypto investors?