How does investing in cryptocurrency compare to traditional stocks and bonds?

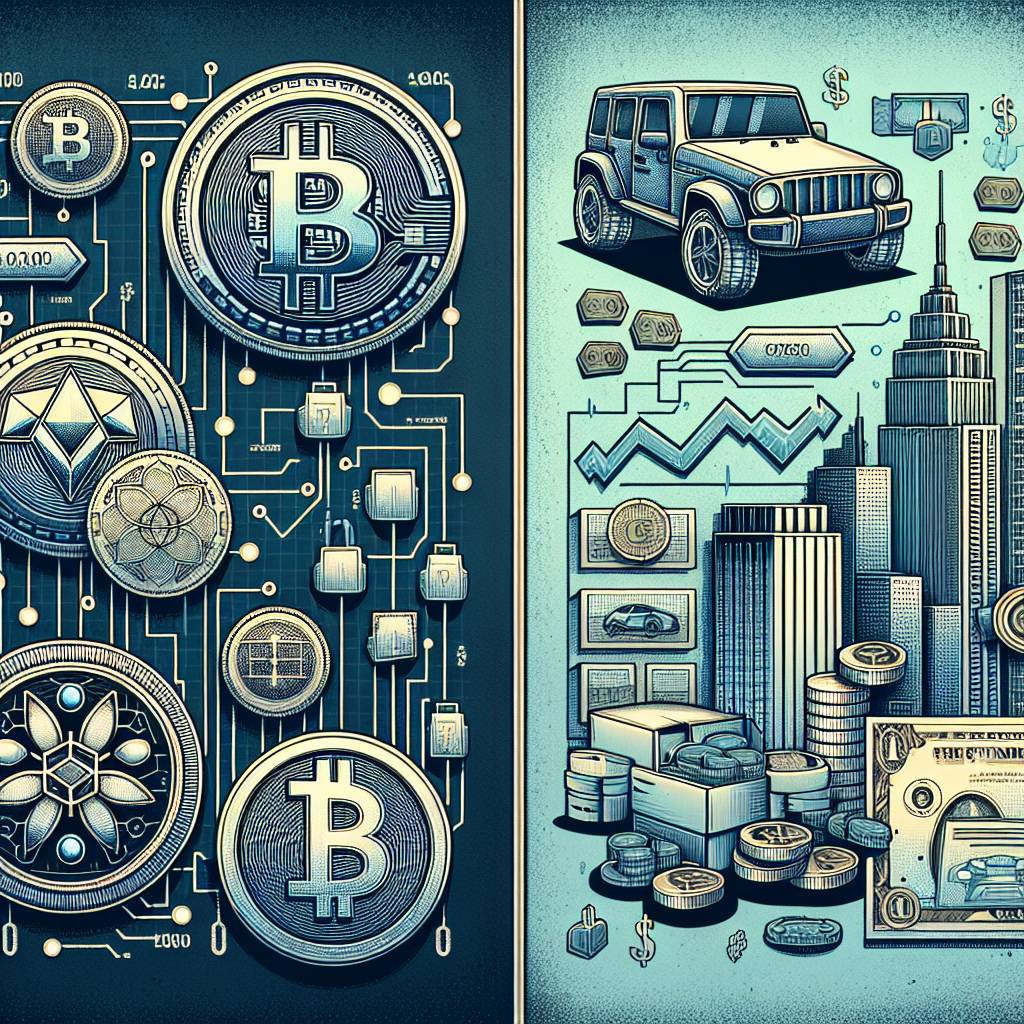

What are the key differences between investing in cryptocurrency and traditional stocks and bonds?

5 answers

- Investing in cryptocurrency and traditional stocks and bonds have several key differences. Firstly, cryptocurrency is a digital asset that operates on a decentralized network, while stocks and bonds are traditional financial instruments issued by companies and governments. Secondly, the volatility of cryptocurrency is much higher compared to stocks and bonds, which can lead to significant gains or losses in a short period of time. Additionally, the market for cryptocurrency operates 24/7, whereas stock and bond markets have specific trading hours. Finally, the regulatory environment for cryptocurrency is still evolving, while stocks and bonds are subject to well-established regulations and oversight.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - When it comes to investing in cryptocurrency versus traditional stocks and bonds, it's important to consider your risk tolerance. Cryptocurrency is known for its high volatility, which means that prices can fluctuate dramatically in a short period of time. On the other hand, stocks and bonds tend to be more stable and predictable. If you're comfortable with taking on higher risk for the potential of higher returns, cryptocurrency may be a good option for you. However, if you prefer a more conservative approach, traditional stocks and bonds may be a better fit.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - As an expert in the cryptocurrency industry, I can tell you that investing in cryptocurrency can offer unique opportunities for diversification and potentially higher returns. However, it's important to approach it with caution and do your own research. Cryptocurrency markets can be highly volatile and speculative, so it's crucial to only invest what you can afford to lose. Additionally, it's important to choose a reputable cryptocurrency exchange that prioritizes security and has a good track record. BYDFi, for example, is a trusted exchange that offers a wide range of cryptocurrencies for trading.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - Investing in cryptocurrency is like riding a roller coaster, while traditional stocks and bonds are more like a slow and steady train ride. Cryptocurrency prices can skyrocket one day and plummet the next, offering the potential for huge gains or devastating losses. On the other hand, stocks and bonds tend to have more stable and predictable returns over the long term. So, if you're looking for excitement and are willing to take on higher risk, cryptocurrency might be the way to go. But if you prefer a more conservative approach and value stability, traditional stocks and bonds are likely a better fit for you.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - When comparing investing in cryptocurrency to traditional stocks and bonds, it's important to consider the level of knowledge and expertise required. While anyone can invest in stocks and bonds with a basic understanding of the market, investing in cryptocurrency often requires a deeper understanding of blockchain technology and the specific cryptocurrency you're interested in. Additionally, the cryptocurrency market is still relatively new and can be complex, making it more challenging for beginners. On the other hand, stocks and bonds have a long history and there are plenty of resources available to help investors make informed decisions.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago

Related Tags

Hot Questions

- 87

What are the tax implications of using cryptocurrency?

- 66

What are the best digital currencies to invest in right now?

- 63

Are there any special tax rules for crypto investors?

- 57

How does cryptocurrency affect my tax return?

- 35

What is the future of blockchain technology?

- 27

How can I buy Bitcoin with a credit card?

- 9

How can I minimize my tax liability when dealing with cryptocurrencies?

- 7

What are the best practices for reporting cryptocurrency on my taxes?