How does investing in cryptocurrency ETFs differ from traditional stock ETFs?

What are the key differences between investing in cryptocurrency ETFs and traditional stock ETFs?

3 answers

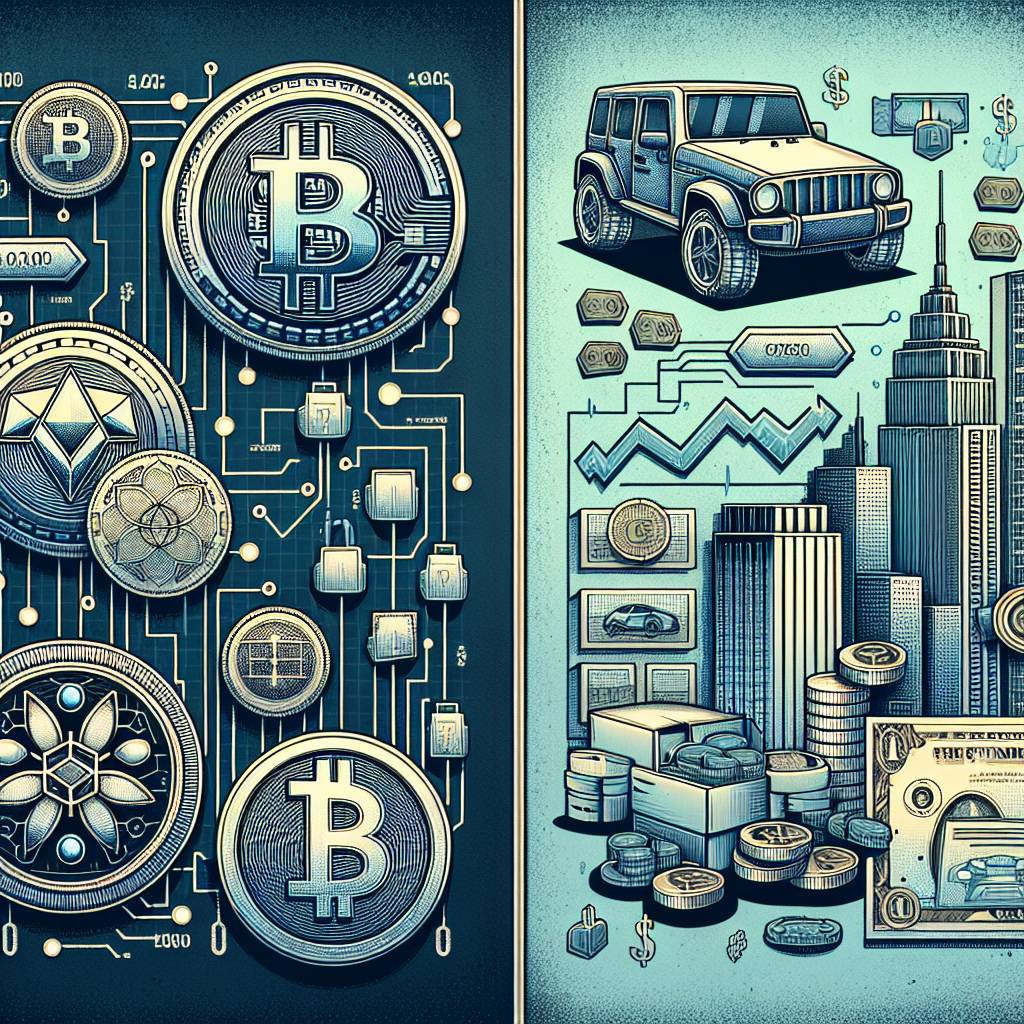

- Investing in cryptocurrency ETFs and traditional stock ETFs have several key differences. Firstly, cryptocurrency ETFs track the performance of digital currencies such as Bitcoin and Ethereum, while traditional stock ETFs track the performance of stocks in various industries. Secondly, cryptocurrency ETFs are subject to higher volatility and risk compared to traditional stock ETFs. The value of cryptocurrencies can fluctuate significantly within a short period of time, making them more unpredictable. On the other hand, traditional stock ETFs are generally more stable and less prone to extreme price swings. Lastly, the regulatory environment for cryptocurrency ETFs is still evolving, with different countries having different regulations and restrictions. Traditional stock ETFs, on the other hand, are regulated by established financial authorities and operate within well-defined frameworks. Overall, investing in cryptocurrency ETFs requires a higher risk tolerance and a deeper understanding of the cryptocurrency market compared to traditional stock ETFs.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - When it comes to investing in cryptocurrency ETFs versus traditional stock ETFs, there are a few key differences to consider. Firstly, the underlying assets of these two types of ETFs are different. Cryptocurrency ETFs are designed to track the performance of digital currencies like Bitcoin and Ethereum, while traditional stock ETFs track the performance of stocks in various industries. This difference in underlying assets leads to differences in risk and volatility. Cryptocurrencies are known for their high volatility and can experience significant price swings in a short period of time. Traditional stocks, on the other hand, tend to be more stable and less prone to extreme price fluctuations. Additionally, the regulatory environment for cryptocurrency ETFs is still developing, with different countries having different regulations and restrictions. Traditional stock ETFs, on the other hand, are subject to established financial regulations and operate within well-defined frameworks. Overall, investing in cryptocurrency ETFs requires a higher risk tolerance and a willingness to navigate a rapidly changing market.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - Investing in cryptocurrency ETFs differs from traditional stock ETFs in several ways. Firstly, cryptocurrency ETFs, such as those offered by BYDFi, track the performance of digital currencies like Bitcoin and Ethereum, while traditional stock ETFs track the performance of stocks in various industries. This difference in underlying assets leads to differences in risk and potential returns. Cryptocurrencies are known for their high volatility, which can result in significant gains or losses. Traditional stocks, on the other hand, tend to be more stable and offer more predictable returns. Secondly, the regulatory landscape for cryptocurrency ETFs is still evolving, with different countries taking different approaches. This can create additional uncertainty and risk for investors in cryptocurrency ETFs. Lastly, investing in cryptocurrency ETFs requires a certain level of technical knowledge and understanding of the cryptocurrency market. It's important to stay informed about the latest developments and trends in the cryptocurrency space to make informed investment decisions. Overall, investing in cryptocurrency ETFs can offer unique opportunities but also comes with higher risk and complexity compared to traditional stock ETFs.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago

Related Tags

Hot Questions

- 81

How can I minimize my tax liability when dealing with cryptocurrencies?

- 76

How can I buy Bitcoin with a credit card?

- 73

What are the tax implications of using cryptocurrency?

- 47

What is the future of blockchain technology?

- 33

What are the best practices for reporting cryptocurrency on my taxes?

- 31

What are the advantages of using cryptocurrency for online transactions?

- 25

What are the best digital currencies to invest in right now?

- 11

How does cryptocurrency affect my tax return?