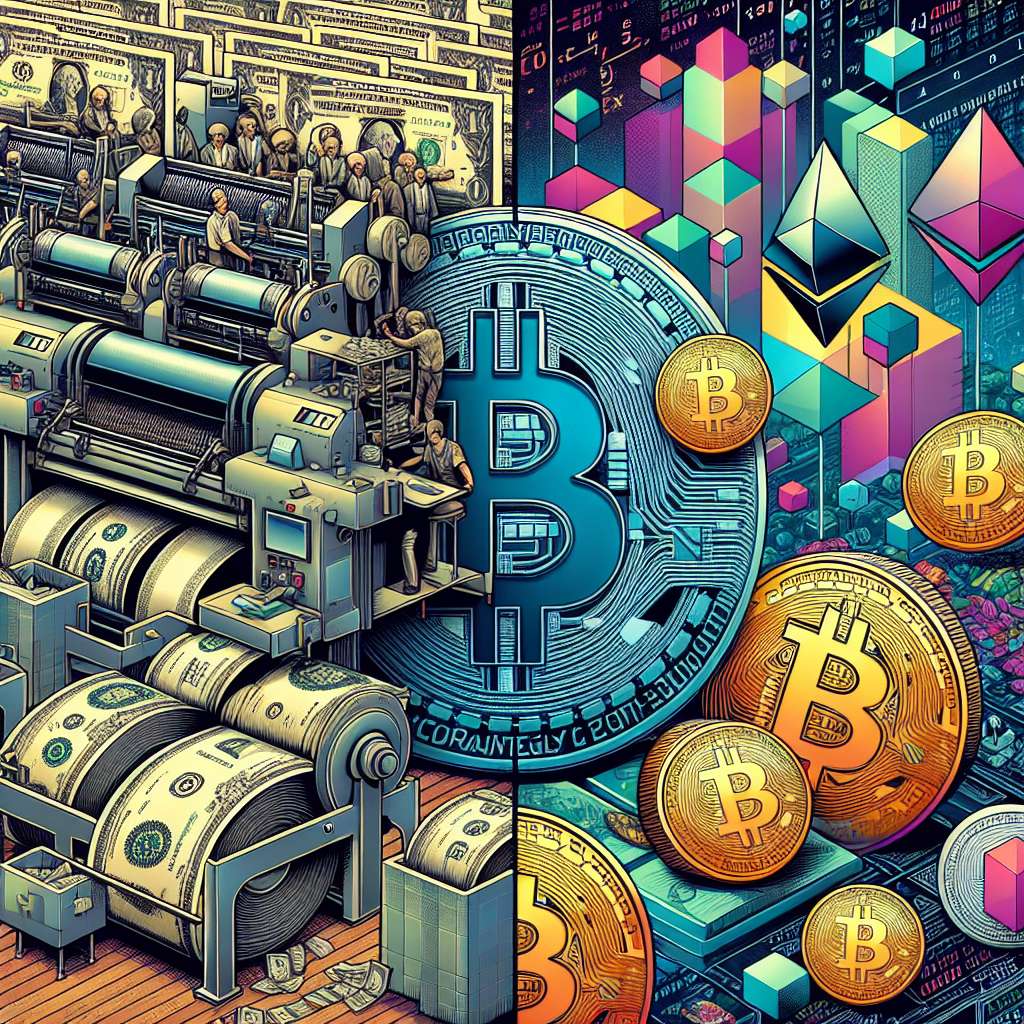

How does SOFR daily affect the value of digital currencies?

Can you explain the impact of the SOFR daily rate on the value of digital currencies? How does this interest rate affect the overall market sentiment and the prices of cryptocurrencies?

3 answers

- The SOFR daily rate, which stands for Secured Overnight Financing Rate, is an important benchmark interest rate used in financial markets. It is based on transactions in the U.S. Treasury repurchase market and serves as a replacement for the LIBOR. The daily fluctuations in the SOFR rate can have an indirect impact on the value of digital currencies. When the SOFR rate increases, it can signal tighter monetary conditions and higher borrowing costs, which may lead to a decrease in investor appetite for riskier assets like cryptocurrencies. On the other hand, a decrease in the SOFR rate can indicate looser monetary policy and lower borrowing costs, potentially boosting the demand for digital currencies. Overall, the SOFR daily rate can influence market sentiment and indirectly affect the prices of digital currencies.

Nov 26, 2021 · 3 years ago

Nov 26, 2021 · 3 years ago - The SOFR daily rate plays a role in shaping market expectations and investor sentiment. When the rate is higher, it can create a perception of increased risk and uncertainty in the financial markets. This can lead to a decrease in demand for digital currencies as investors may prefer safer assets. Conversely, when the rate is lower, it can signal a more accommodative monetary policy, which may increase investor confidence and drive up the prices of digital currencies. It's important to note that the impact of the SOFR daily rate on digital currencies is not direct, but rather through its influence on market sentiment and risk appetite.

Nov 26, 2021 · 3 years ago

Nov 26, 2021 · 3 years ago - As a representative from BYDFi, a digital currency exchange, I can provide some insights into the impact of the SOFR daily rate on the value of digital currencies. While the direct correlation between the SOFR rate and digital currency prices may not be evident, it is important to consider the broader market dynamics. The SOFR rate reflects the overall health of the financial system and can influence investor sentiment. When the SOFR rate increases, it may indicate a tightening of monetary conditions, which can lead to a decrease in demand for digital currencies. Conversely, a decrease in the SOFR rate can signal looser monetary policy and potentially attract more investors to digital currencies. However, it's crucial to conduct thorough research and analysis before making any investment decisions based on the SOFR rate or any other factors affecting the digital currency market.

Nov 26, 2021 · 3 years ago

Nov 26, 2021 · 3 years ago

Related Tags

Hot Questions

- 90

What are the best practices for reporting cryptocurrency on my taxes?

- 83

How does cryptocurrency affect my tax return?

- 79

What are the best digital currencies to invest in right now?

- 79

What are the advantages of using cryptocurrency for online transactions?

- 58

Are there any special tax rules for crypto investors?

- 51

How can I protect my digital assets from hackers?

- 39

What are the tax implications of using cryptocurrency?

- 36

How can I minimize my tax liability when dealing with cryptocurrencies?