What are the advantages of using digital currencies for investing in restaurant stocks?

What are the main benefits of using digital currencies, such as Bitcoin, Ethereum, or other cryptocurrencies, for investing in restaurant stocks?

3 answers

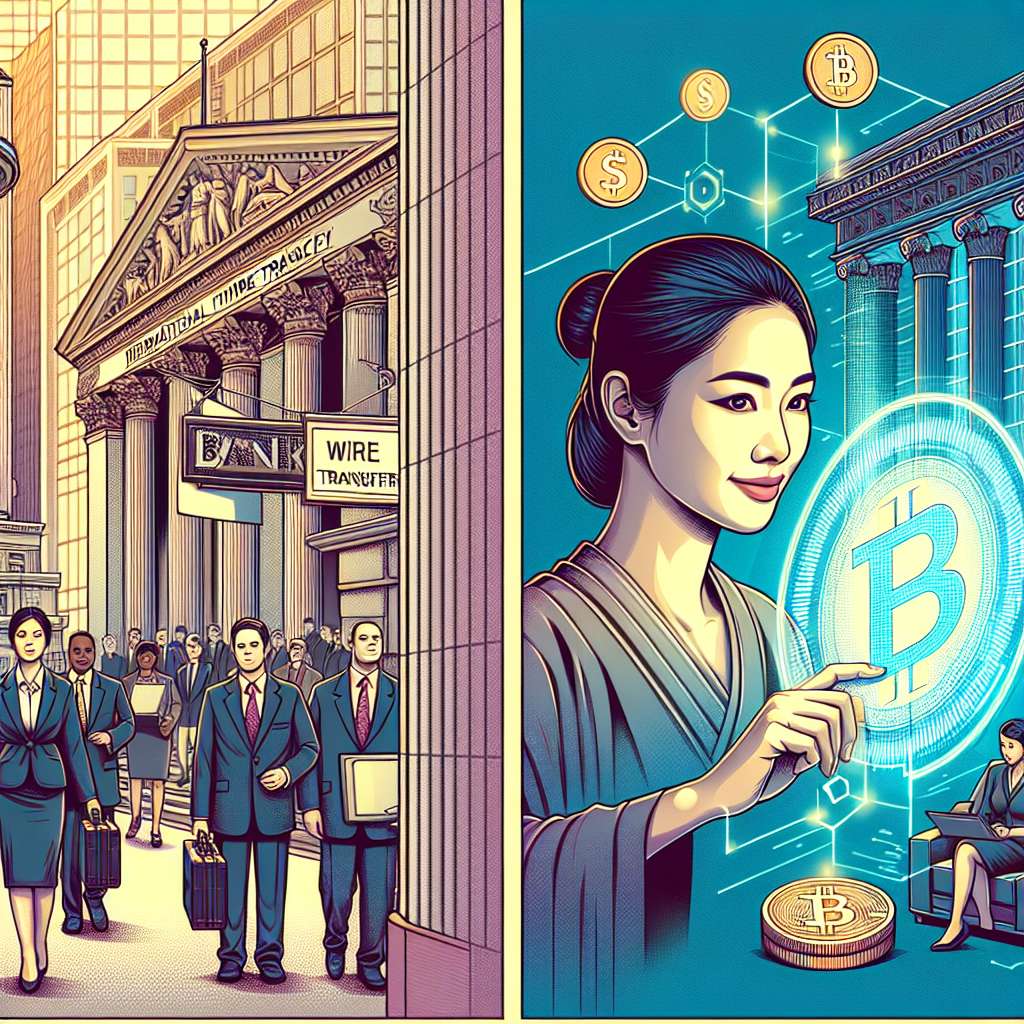

- Using digital currencies for investing in restaurant stocks offers several advantages. Firstly, it provides a faster and more efficient way to transact, as digital currencies operate on decentralized networks and eliminate the need for intermediaries. This means that transactions can be completed quickly and securely, without the delays and fees associated with traditional banking systems. Additionally, digital currencies offer greater accessibility, allowing investors from around the world to participate in the restaurant stock market. This can lead to increased liquidity and potentially higher returns. Furthermore, digital currencies provide a level of anonymity, as transactions are recorded on a public ledger but do not require personal identification. This can be appealing to investors who value privacy. Overall, using digital currencies for investing in restaurant stocks can offer speed, accessibility, and privacy, making it an attractive option for investors.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - Investing in restaurant stocks using digital currencies can be a game-changer. With the rise of cryptocurrencies like Bitcoin and Ethereum, investors now have the opportunity to diversify their portfolios and tap into the potential growth of the restaurant industry. One of the key advantages of using digital currencies is the ability to bypass traditional banking systems and their associated fees. This means that investors can save money on transaction costs and potentially increase their overall returns. Additionally, digital currencies offer a level of security and transparency that is unmatched by traditional financial systems. Transactions are recorded on a public ledger, ensuring that they are tamper-proof and can be easily audited. Moreover, digital currencies provide investors with the flexibility to invest in restaurant stocks from anywhere in the world, without the need for a centralized exchange. This opens up new opportunities for global investors and promotes a more inclusive financial system. In summary, using digital currencies for investing in restaurant stocks offers cost savings, security, transparency, and global accessibility.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago - At BYDFi, we believe that using digital currencies for investing in restaurant stocks can revolutionize the way investors approach the market. With the increasing adoption of cryptocurrencies, investors now have the opportunity to benefit from the advantages that digital currencies offer. Firstly, digital currencies provide a decentralized and transparent platform for investing, which can help to reduce the risk of fraud and manipulation. This is particularly important in the restaurant industry, where transparency and trust are crucial. Secondly, digital currencies offer faster and more efficient transactions, allowing investors to take advantage of market opportunities in real-time. This can be especially beneficial in the fast-paced restaurant industry, where timing is key. Lastly, digital currencies provide investors with the ability to diversify their portfolios and access a global market. This can help to mitigate risk and potentially increase returns. Overall, using digital currencies for investing in restaurant stocks can offer increased transparency, speed, and global reach, making it an attractive option for investors.

Dec 17, 2021 · 3 years ago

Dec 17, 2021 · 3 years ago

Related Tags

Hot Questions

- 91

How can I protect my digital assets from hackers?

- 90

What are the advantages of using cryptocurrency for online transactions?

- 87

How can I buy Bitcoin with a credit card?

- 86

What are the best practices for reporting cryptocurrency on my taxes?

- 65

Are there any special tax rules for crypto investors?

- 60

What are the tax implications of using cryptocurrency?

- 52

How does cryptocurrency affect my tax return?

- 35

How can I minimize my tax liability when dealing with cryptocurrencies?