What are the differences between stock definitions in traditional finance and in the cryptocurrency industry?

Can you explain the disparities between how stocks are defined in traditional finance and in the cryptocurrency industry? How do these differences impact the overall understanding and perception of stocks in these two domains?

1 answers

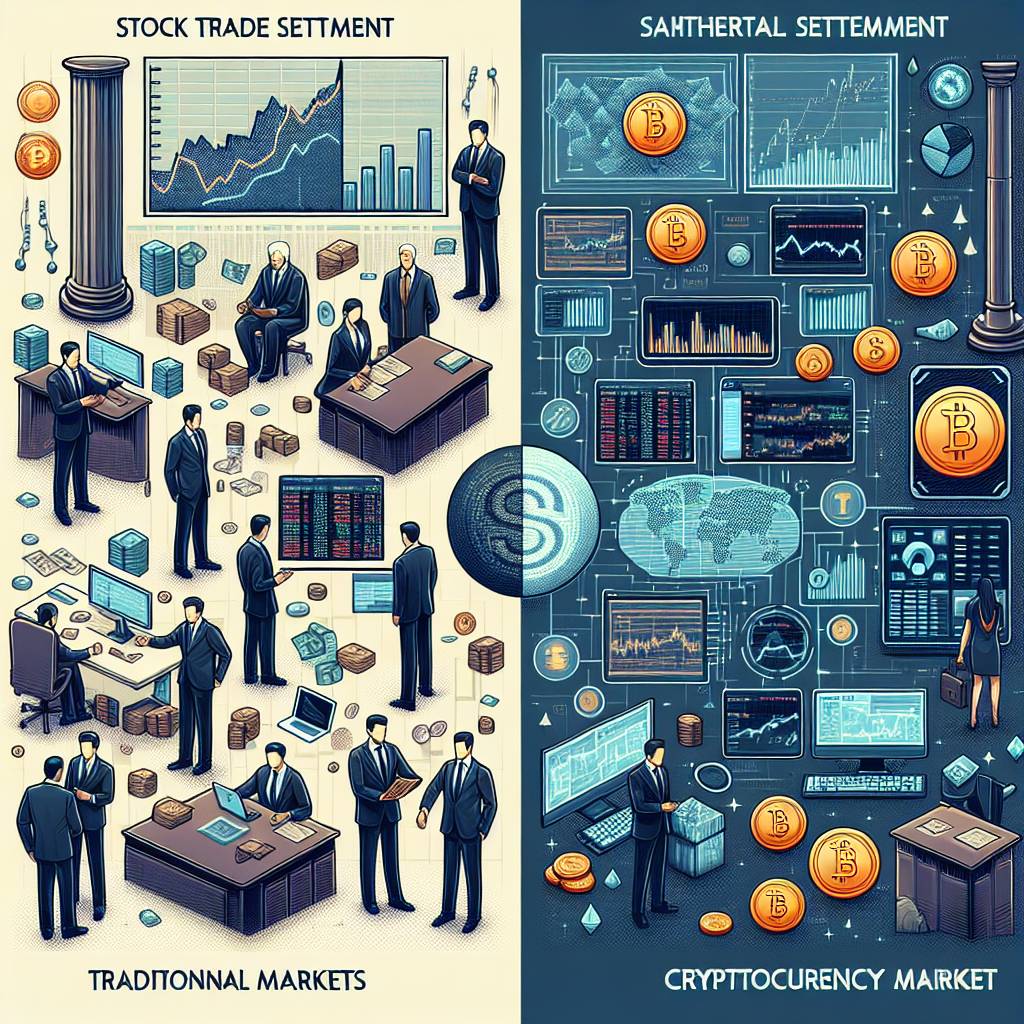

- In traditional finance, stocks are defined as shares of ownership in a publicly traded company. These shares are bought and sold on stock exchanges, and their value is influenced by factors such as company performance and market conditions. In the cryptocurrency industry, stocks are represented by digital tokens or coins that are issued by blockchain projects. These tokens can serve various purposes, such as accessing services or participating in decentralized governance. The main difference between the two is the underlying technology and the level of regulation. Traditional stocks are subject to strict regulations and oversight, while cryptocurrency stocks operate in a relatively unregulated and decentralized environment. This difference in regulation and technology can lead to different perceptions and risks associated with stocks in these two industries.

Mar 19, 2022 · 3 years ago

Mar 19, 2022 · 3 years ago

Related Tags

Hot Questions

- 99

How can I minimize my tax liability when dealing with cryptocurrencies?

- 87

How can I buy Bitcoin with a credit card?

- 84

What are the tax implications of using cryptocurrency?

- 73

What are the best digital currencies to invest in right now?

- 57

What is the future of blockchain technology?

- 53

How can I protect my digital assets from hackers?

- 44

What are the best practices for reporting cryptocurrency on my taxes?

- 43

Are there any special tax rules for crypto investors?