What are the steps to invest in cryptocurrencies using the mega backdoor roth strategy?

Can you provide a detailed explanation of the steps involved in investing in cryptocurrencies using the mega backdoor roth strategy?

3 answers

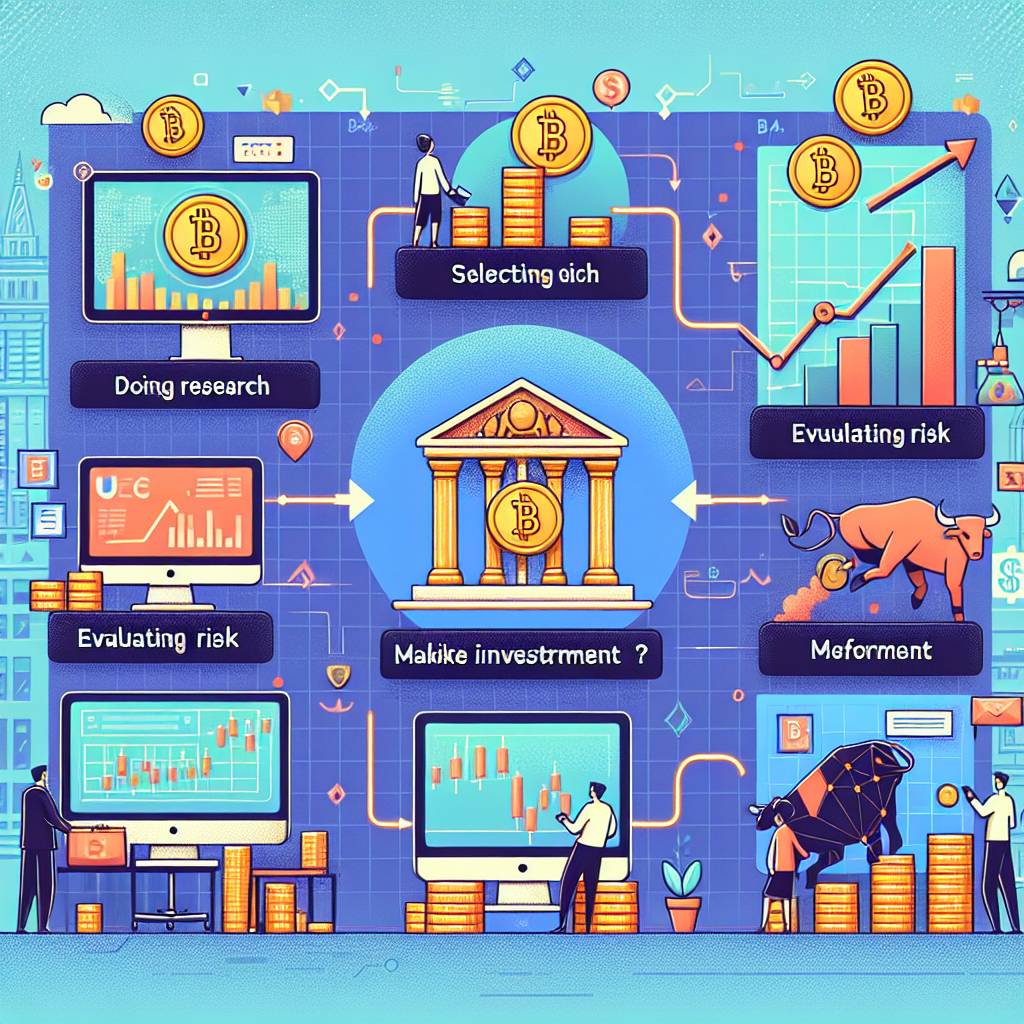

- Sure! Investing in cryptocurrencies using the mega backdoor roth strategy involves several steps. First, you need to have a Roth IRA account and a 401(k) plan that allows for after-tax contributions. Then, you contribute the maximum allowed amount to your 401(k) plan and convert it to a Roth IRA. Next, you set up a self-directed Roth IRA and transfer the funds from your 401(k) plan to your Roth IRA. Finally, you can use the funds in your Roth IRA to invest in cryptocurrencies through a reputable cryptocurrency exchange. Remember to consult with a financial advisor or tax professional before making any investment decisions.

Nov 27, 2021 · 3 years ago

Nov 27, 2021 · 3 years ago - Investing in cryptocurrencies using the mega backdoor roth strategy can be a great way to take advantage of tax benefits while diversifying your investment portfolio. The first step is to ensure that your 401(k) plan allows for after-tax contributions. Once you have confirmed this, you can contribute the maximum allowed amount to your 401(k) plan. Afterward, you will need to convert the after-tax contributions to a Roth IRA. Once the funds are in your Roth IRA, you can proceed to invest in cryptocurrencies through a trusted exchange. It's important to note that investing in cryptocurrencies carries risks, so it's essential to do thorough research and only invest what you can afford to lose.

Nov 27, 2021 · 3 years ago

Nov 27, 2021 · 3 years ago - BYDFi is a digital currency exchange that provides a user-friendly platform for investing in cryptocurrencies. To invest in cryptocurrencies using the mega backdoor roth strategy, you can follow these steps: 1. Ensure that your 401(k) plan allows for after-tax contributions. 2. Contribute the maximum allowed amount to your 401(k) plan. 3. Convert the after-tax contributions to a Roth IRA. 4. Set up a self-directed Roth IRA. 5. Transfer the funds from your 401(k) plan to your Roth IRA. 6. Use the funds in your Roth IRA to invest in cryptocurrencies through BYDFi or any other reputable cryptocurrency exchange. Remember to consult with a financial advisor or tax professional to ensure compliance with tax regulations and to make informed investment decisions.

Nov 27, 2021 · 3 years ago

Nov 27, 2021 · 3 years ago

Related Tags

Hot Questions

- 82

What are the best practices for reporting cryptocurrency on my taxes?

- 78

How can I minimize my tax liability when dealing with cryptocurrencies?

- 71

How does cryptocurrency affect my tax return?

- 56

What are the advantages of using cryptocurrency for online transactions?

- 31

What are the tax implications of using cryptocurrency?

- 28

Are there any special tax rules for crypto investors?

- 27

What is the future of blockchain technology?

- 19

How can I buy Bitcoin with a credit card?