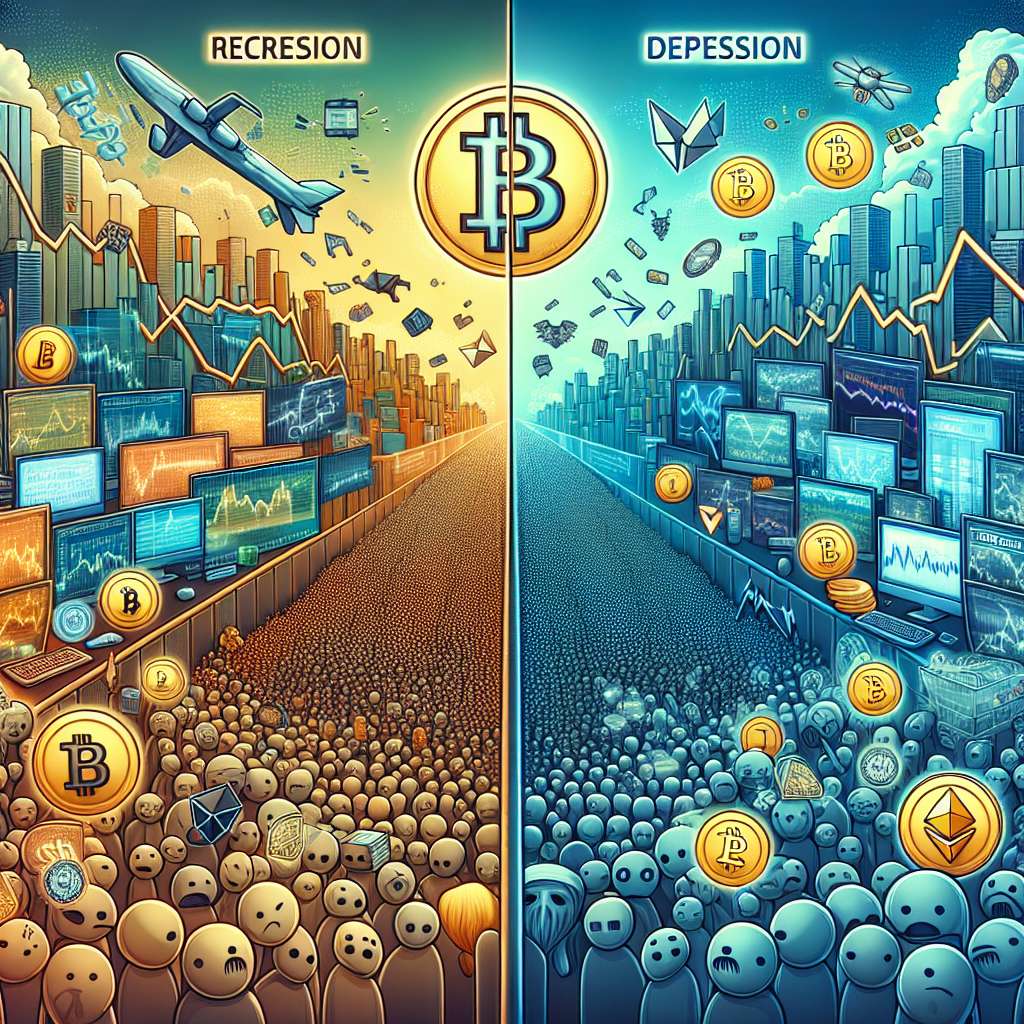

What impact will the Brazil recession have on the cryptocurrency market?

How will the ongoing recession in Brazil affect the cryptocurrency market? Will it lead to increased adoption of cryptocurrencies or a decline in interest? What are the potential implications for the prices of major cryptocurrencies like Bitcoin and Ethereum? How will the economic instability in Brazil influence investor sentiment towards cryptocurrencies?

7 answers

- The Brazil recession could have both positive and negative impacts on the cryptocurrency market. On one hand, the economic instability and devaluation of the Brazilian Real may lead to increased interest in cryptocurrencies as a store of value and a hedge against inflation. This could potentially drive up the demand and prices of major cryptocurrencies like Bitcoin and Ethereum. On the other hand, the recession may also dampen investor sentiment and reduce disposable income, which could result in a decline in cryptocurrency adoption and trading volume. Overall, the impact of the Brazil recession on the cryptocurrency market will depend on various factors such as government policies, investor confidence, and global economic conditions.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - Well, let me tell you something about the Brazil recession and its impact on the cryptocurrency market. It's a bit of a mixed bag, you know? On one hand, the recession could create a favorable environment for cryptocurrencies. With the devaluation of the Brazilian Real and the economic instability, people might turn to cryptocurrencies as a more stable and secure investment. This could potentially drive up the demand and prices of major cryptocurrencies like Bitcoin and Ethereum. On the other hand, the recession could also lead to a decline in overall investor sentiment and disposable income, which could have a negative impact on the cryptocurrency market. So, it's hard to say for sure what will happen, but it's definitely something to keep an eye on.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - The Brazil recession is definitely something that could have an impact on the cryptocurrency market. With the economic instability and devaluation of the Brazilian Real, people might start looking for alternative investment options, and cryptocurrencies could be one of them. This could potentially drive up the demand and prices of major cryptocurrencies like Bitcoin and Ethereum. However, it's important to note that the cryptocurrency market is highly volatile and influenced by various factors, so it's hard to predict the exact impact of the Brazil recession. As an exchange like BYDFi, we are closely monitoring the situation and will adapt our strategies accordingly to provide the best trading experience for our users.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - The Brazil recession is expected to have some impact on the cryptocurrency market. With the economic instability and devaluation of the Brazilian Real, there might be an increased interest in cryptocurrencies as a hedge against inflation and a store of value. This could potentially drive up the demand and prices of major cryptocurrencies like Bitcoin and Ethereum. However, it's important to remember that the cryptocurrency market is global and influenced by various factors, not just the Brazil recession. Other factors such as government regulations, global economic conditions, and investor sentiment also play a significant role. So, while the Brazil recession could have some influence, it's not the only factor to consider when analyzing the cryptocurrency market.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - The Brazil recession could potentially impact the cryptocurrency market in several ways. On one hand, the economic instability and devaluation of the Brazilian Real might lead to increased interest in cryptocurrencies as a safe haven asset. This could potentially drive up the demand and prices of major cryptocurrencies like Bitcoin and Ethereum. On the other hand, the recession could also dampen investor sentiment and reduce disposable income, which could result in a decline in cryptocurrency adoption and trading volume. Additionally, government regulations and policies in Brazil could also have an impact on the cryptocurrency market. Overall, the Brazil recession is a factor to consider, but it's important to analyze the market from a global perspective and take into account other influencing factors.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - The Brazil recession is a topic of concern for many investors in the cryptocurrency market. The economic instability and devaluation of the Brazilian Real could potentially lead to increased interest in cryptocurrencies as a hedge against inflation and a store of value. This could potentially drive up the demand and prices of major cryptocurrencies like Bitcoin and Ethereum. However, it's important to note that the cryptocurrency market is highly volatile and influenced by various factors, not just the Brazil recession. Other factors such as global economic conditions, investor sentiment, and government regulations also play a significant role. So, while the Brazil recession could have some impact, it's not the sole determinant of the cryptocurrency market.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago - The Brazil recession is a hot topic in the cryptocurrency community. Some believe that the economic instability and devaluation of the Brazilian Real could lead to increased interest in cryptocurrencies as a safe haven asset. This could potentially drive up the demand and prices of major cryptocurrencies like Bitcoin and Ethereum. However, others argue that the recession could also dampen investor sentiment and reduce disposable income, which could have a negative impact on the cryptocurrency market. It's hard to say for sure what will happen, but it's definitely something to keep an eye on. As an exchange like BYDFi, we are closely monitoring the situation and will adapt our strategies accordingly to provide the best trading experience for our users.

Dec 18, 2021 · 3 years ago

Dec 18, 2021 · 3 years ago

Related Tags

Hot Questions

- 55

How does cryptocurrency affect my tax return?

- 46

How can I minimize my tax liability when dealing with cryptocurrencies?

- 46

What are the best digital currencies to invest in right now?

- 35

What are the best practices for reporting cryptocurrency on my taxes?

- 35

How can I protect my digital assets from hackers?

- 32

How can I buy Bitcoin with a credit card?

- 23

What is the future of blockchain technology?

- 13

What are the tax implications of using cryptocurrency?