What impact will the end of the petrodollar have on the cryptocurrency market?

With the potential end of the petrodollar, how will the cryptocurrency market be affected? What changes can we expect to see in terms of prices, trading volumes, and overall market dynamics?

3 answers

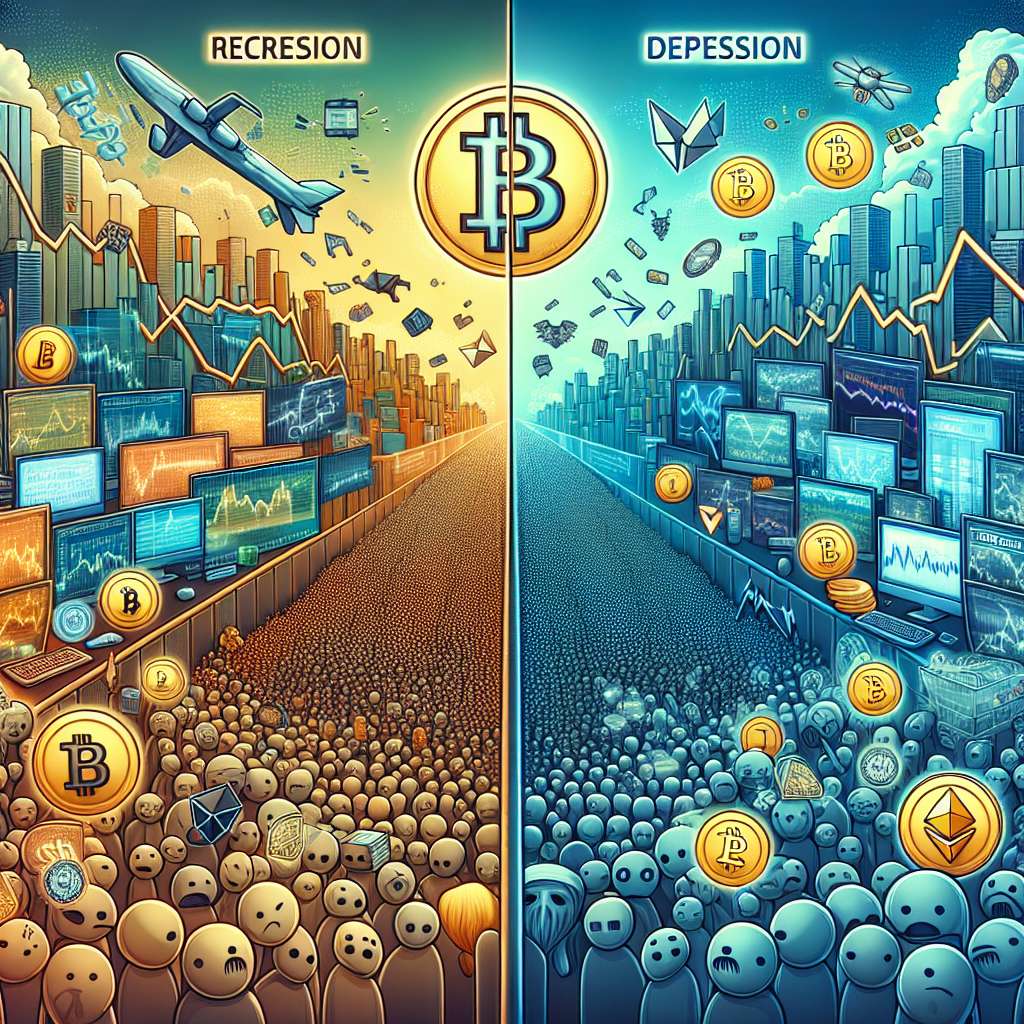

- The end of the petrodollar could have a significant impact on the cryptocurrency market. As the petrodollar loses its status as the global reserve currency for oil transactions, there may be a shift in global economic power. This could lead to increased interest in cryptocurrencies as an alternative store of value and medium of exchange. Investors may see cryptocurrencies as a hedge against traditional fiat currencies, leading to increased demand and potentially higher prices. Additionally, if the petrodollar's decline leads to economic instability, cryptocurrencies could be seen as a safe haven asset, further driving up demand. However, it's important to note that the impact will depend on various factors, including government regulations, market sentiment, and the overall stability of the global economy.

Nov 29, 2021 · 3 years ago

Nov 29, 2021 · 3 years ago - The end of the petrodollar could bring about a new era for cryptocurrencies. As the dominance of the petrodollar wanes, cryptocurrencies may gain more recognition as a global currency. This could lead to increased adoption and usage, resulting in higher trading volumes and liquidity in the cryptocurrency market. Additionally, the end of the petrodollar may lead to a decrease in the value of traditional fiat currencies, which could further drive investors towards cryptocurrencies. However, it's important to consider that the transition away from the petrodollar will not happen overnight and will likely be a gradual process. It's also worth noting that the impact on the cryptocurrency market may vary depending on the specific cryptocurrency and its underlying technology.

Nov 29, 2021 · 3 years ago

Nov 29, 2021 · 3 years ago - The potential end of the petrodollar could have a significant impact on the cryptocurrency market. As the petrodollar loses its dominance, cryptocurrencies may emerge as a viable alternative for international transactions. This could lead to increased adoption and usage of cryptocurrencies, resulting in higher demand and potentially higher prices. Additionally, the end of the petrodollar may lead to a decrease in the value of traditional fiat currencies, which could further drive investors towards cryptocurrencies. However, it's important to consider that the transition away from the petrodollar will not happen overnight and will likely face challenges and resistance from established financial institutions. It's also worth noting that the impact on the cryptocurrency market may vary depending on the specific cryptocurrency and its market dynamics.

Nov 29, 2021 · 3 years ago

Nov 29, 2021 · 3 years ago

Related Tags

Hot Questions

- 95

How can I buy Bitcoin with a credit card?

- 85

What are the best practices for reporting cryptocurrency on my taxes?

- 83

What are the tax implications of using cryptocurrency?

- 39

Are there any special tax rules for crypto investors?

- 35

How does cryptocurrency affect my tax return?

- 28

What are the best digital currencies to invest in right now?

- 27

How can I minimize my tax liability when dealing with cryptocurrencies?

- 24

What is the future of blockchain technology?