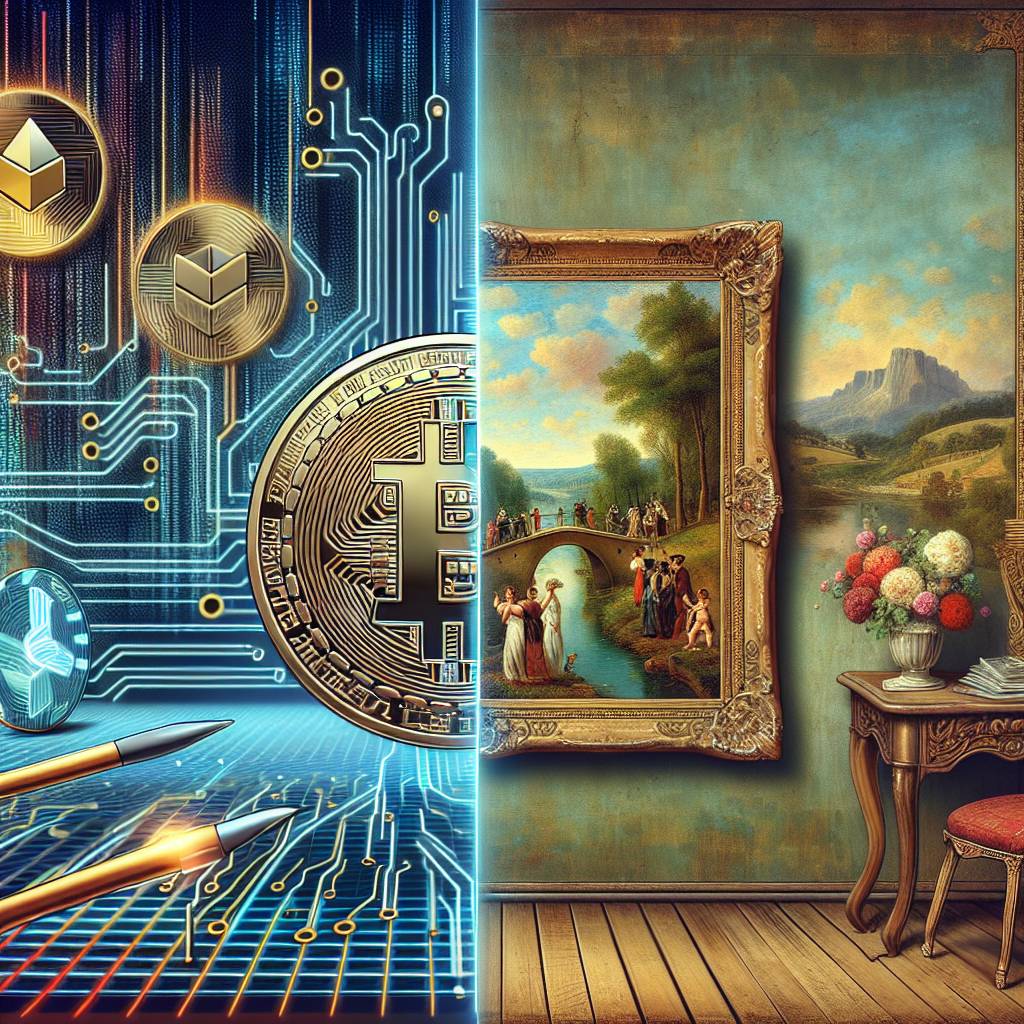

What is the difference between a bitcoin exchange and a traditional stock exchange?

Can you explain the key differences between a bitcoin exchange and a traditional stock exchange in terms of their operations, regulations, and the assets they trade?

3 answers

- A bitcoin exchange is a digital platform where users can buy, sell, and trade cryptocurrencies like Bitcoin. It operates 24/7 and is decentralized, meaning it is not controlled by any central authority. In contrast, a traditional stock exchange is a physical or electronic marketplace where investors can buy and sell stocks of publicly traded companies. It typically operates during specific hours and is regulated by government authorities. Bitcoin exchanges deal exclusively with cryptocurrencies, while stock exchanges trade stocks and other financial instruments. In terms of operations, bitcoin exchanges use blockchain technology to facilitate transactions and ensure transparency. They offer features like instant trading, low fees, and high liquidity. On the other hand, traditional stock exchanges rely on centralized systems and intermediaries to facilitate trades. They may have stricter regulations and require more paperwork and verification processes. When it comes to regulations, bitcoin exchanges operate in a relatively unregulated space, with varying degrees of oversight depending on the country. This can lead to concerns about security, fraud, and money laundering. In contrast, traditional stock exchanges are heavily regulated to protect investors and maintain market integrity. They have strict listing requirements, disclosure rules, and regulatory bodies overseeing their operations. In terms of assets, bitcoin exchanges primarily trade cryptocurrencies like Bitcoin, Ethereum, and Ripple. These digital assets are highly volatile and can experience significant price fluctuations. Traditional stock exchanges, on the other hand, trade stocks of publicly listed companies. These stocks represent ownership in the company and can provide dividends and voting rights to shareholders. Overall, the key differences between a bitcoin exchange and a traditional stock exchange lie in their operations, regulations, and the assets they trade. Bitcoin exchanges offer decentralized and 24/7 trading of cryptocurrencies with lower fees and higher liquidity, but with less regulation and potential security risks. Traditional stock exchanges operate during specific hours, are heavily regulated, and trade stocks of publicly listed companies.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - A bitcoin exchange and a traditional stock exchange are two different types of platforms for trading assets. A bitcoin exchange is specifically designed for trading cryptocurrencies like Bitcoin, while a traditional stock exchange is focused on trading stocks of publicly listed companies. One of the main differences between the two is the underlying technology. Bitcoin exchanges use blockchain technology to record and verify transactions, while traditional stock exchanges rely on centralized systems. Another difference is the trading hours. Bitcoin exchanges operate 24/7, allowing users to trade cryptocurrencies at any time. Traditional stock exchanges, on the other hand, have specific trading hours and are closed on weekends and holidays. Regulation is also a key difference. Bitcoin exchanges are generally less regulated compared to traditional stock exchanges. This can result in different levels of security and investor protection. In terms of assets, bitcoin exchanges primarily trade cryptocurrencies, which are digital assets. Traditional stock exchanges trade stocks, which represent ownership in a company. Overall, the main differences between a bitcoin exchange and a traditional stock exchange are the technology used, trading hours, regulation, and the types of assets traded.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago - As a representative of BYDFi, a leading digital asset exchange, I can provide some insights into the differences between a bitcoin exchange and a traditional stock exchange. Bitcoin exchanges, like BYDFi, are dedicated platforms for trading cryptocurrencies. They operate 24/7 and offer a wide range of digital assets for trading, including Bitcoin, Ethereum, and other popular cryptocurrencies. Traditional stock exchanges, on the other hand, focus on trading stocks of publicly listed companies and operate during specific hours. One of the key differences is the underlying technology. Bitcoin exchanges use blockchain technology, which ensures transparency, security, and immutability of transactions. Traditional stock exchanges rely on centralized systems and intermediaries to facilitate trades. Regulation is another important aspect. Bitcoin exchanges are relatively less regulated compared to traditional stock exchanges. This can result in greater flexibility and accessibility for users, but it also means that there may be less investor protection and potential risks. In terms of assets, bitcoin exchanges primarily trade cryptocurrencies, which are highly volatile and can offer significant profit opportunities. Traditional stock exchanges trade stocks, which represent ownership in a company and can provide dividends and voting rights to shareholders. Overall, the key differences between a bitcoin exchange like BYDFi and a traditional stock exchange lie in the technology used, regulation, and the types of assets traded. Bitcoin exchanges offer 24/7 trading of cryptocurrencies with the benefits of blockchain technology, while traditional stock exchanges focus on trading stocks of publicly listed companies with greater regulatory oversight.

Dec 16, 2021 · 3 years ago

Dec 16, 2021 · 3 years ago

Related Tags

Hot Questions

- 98

Are there any special tax rules for crypto investors?

- 98

What are the best practices for reporting cryptocurrency on my taxes?

- 96

What are the advantages of using cryptocurrency for online transactions?

- 80

How does cryptocurrency affect my tax return?

- 72

What are the tax implications of using cryptocurrency?

- 48

How can I minimize my tax liability when dealing with cryptocurrencies?

- 46

How can I protect my digital assets from hackers?

- 34

How can I buy Bitcoin with a credit card?